Considering a personal loan? Understanding when a personal loan is the right financial choice is crucial. This guide will help you navigate the complexities of personal loans, outlining scenarios where they offer significant advantages and situations where alternative options might be more suitable. We’ll explore the pros and cons of personal loans, examining interest rates, repayment terms, and the impact on your overall credit score. Learn how to determine if a personal loan aligns with your financial goals and makes sense for your individual circumstances.

From debt consolidation to home improvements and major purchases, personal loans can provide the funding you need. However, it’s vital to carefully assess your financial situation before applying. This article will equip you with the knowledge to make an informed decision, ensuring you can leverage the power of a personal loan responsibly and achieve your financial objectives without incurring unnecessary debt. We will cover key factors to consider, such as APR (Annual Percentage Rate), loan amounts, and the long-term implications of taking on a personal loan. This comprehensive guide will help you decide if a personal loan truly makes sense for your needs.

Covering Emergency Expenses Responsibly

Unexpected events, such as medical emergencies, car repairs, or home damage, can quickly deplete savings and create significant financial strain. While using a personal loan to cover these emergency expenses can be a viable option, it’s crucial to approach it responsibly.

Before considering a personal loan, explore all other avenues first. This includes evaluating your emergency fund, utilizing existing savings, and considering options like a 0% APR credit card for a short-term solution. Exhausting these alternatives demonstrates financial responsibility and reduces the reliance on borrowed funds.

When a personal loan becomes necessary, carefully compare interest rates and fees across different lenders. Shop around for the best possible terms, focusing on the Annual Percentage Rate (APR), which reflects the total cost of borrowing. Avoid loans with excessively high fees or unfavorable repayment schedules.

Prior to applying, create a realistic budget that incorporates the loan repayment into your monthly expenses. Assess your income and expenditures to determine the maximum loan amount you can comfortably afford without compromising your financial stability. A detailed budget helps prevent defaulting on the loan.

Finally, ensure you thoroughly understand the loan agreement before signing. Read the fine print, paying close attention to the terms and conditions, repayment schedule, and any potential penalties for late payments. Understanding your obligations is paramount to responsible borrowing and preventing long-term financial difficulties.

Consolidating High-Interest Debt

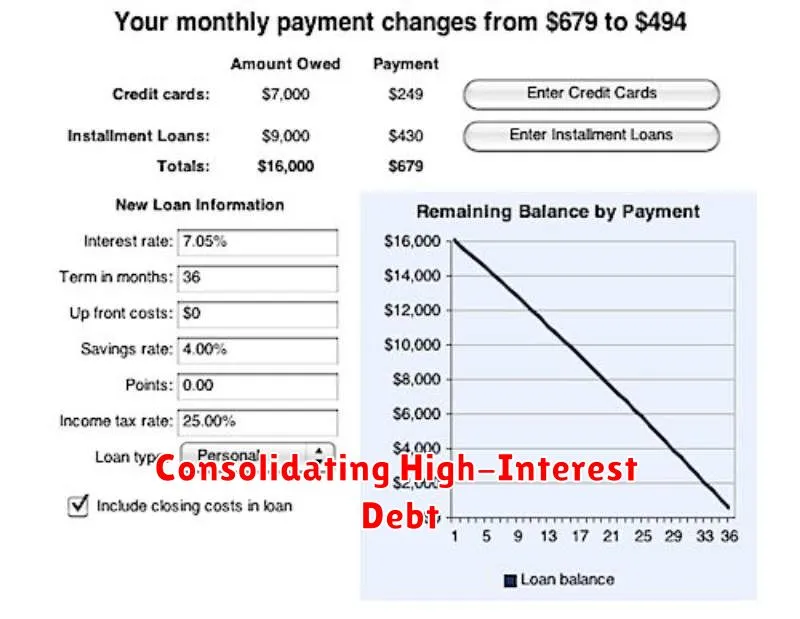

One compelling reason to consider a personal loan is to consolidate high-interest debt. Many individuals find themselves juggling multiple debts, such as credit cards, payday loans, and medical bills, each carrying a potentially high interest rate. This can lead to a complex and overwhelming financial situation.

A personal loan can simplify this by providing a single, lower-interest loan to pay off all existing high-interest debts. This strategy offers several key advantages. Firstly, it streamlines payments, making budgeting and debt management significantly easier. You’ll only have one monthly payment to track rather than multiple, potentially varying, payments.

Secondly, a lower interest rate on a personal loan can lead to substantial savings over time. By consolidating high-interest debts into a lower-interest loan, you’ll pay less in total interest charges, freeing up more of your monthly budget for other financial priorities, such as savings or investments.

However, it’s crucial to carefully consider the terms of the personal loan before proceeding. While a lower interest rate is beneficial, be sure to factor in any origination fees or other associated costs. Comparing offers from multiple lenders is essential to find the best possible terms and avoid ending up with a less favorable deal.

Ultimately, consolidating high-interest debt with a personal loan can be a powerful tool for improving your financial health, provided you do your research and select a loan that aligns with your financial circumstances. It’s important to ensure the monthly payment is manageable and fits within your budget.

Avoiding Credit Card Traps

Before considering a personal loan, it’s crucial to assess your current financial situation, particularly your reliance on credit cards. Many find themselves trapped in a cycle of high-interest debt, making a personal loan a more cost-effective solution in the long run.

One major trap is the high interest rates associated with credit cards. These rates can quickly accumulate, making it difficult to pay down your balance, and ultimately leading to a snowball effect of debt. A personal loan often offers a significantly lower interest rate, providing a path to consolidation and faster debt repayment.

Another significant pitfall is the temptation of minimum payments. While seemingly manageable, consistently only paying the minimum prolongs the repayment period and significantly increases the total interest paid. A personal loan allows for a fixed monthly payment and a predetermined repayment schedule, providing greater clarity and control over your finances.

Furthermore, the ease of access to credit card credit can lead to overspending. By consolidating debt through a personal loan, you gain a clearer picture of your debt burden and have a set budget to adhere to. This can foster better financial discipline and prevent future overspending.

Finally, consider the potential for hidden fees and charges associated with credit cards. Late payment fees, annual fees, and balance transfer fees can quickly add up, hindering your ability to pay down your debt. A personal loan, with its clear terms and conditions, often avoids these unpredictable costs.

Planning Big Purchases with Fixed Terms

A personal loan can be a valuable tool when planning significant purchases, particularly those with fixed terms. This allows you to budget effectively and avoid the potential pitfalls of unexpected interest rate fluctuations or variable repayment schedules.

When considering large purchases like a new car or home renovations, a fixed-term personal loan provides predictability. You’ll know exactly how much you’ll be paying each month for the duration of the loan, simplifying your budgeting and reducing financial stress. This contrasts with financing options that feature variable interest rates, where your monthly payments could change unexpectedly.

Fixed-term loans offer the benefit of transparency. Before you commit, you’ll have a clear understanding of the total interest paid over the life of the loan, allowing you to compare offers and make informed decisions. This transparency makes financial planning much more manageable.

Moreover, securing a loan with a fixed term can provide a sense of financial security. Knowing the precise repayment schedule allows for better long-term financial planning and avoids the uncertainty associated with fluctuating payments.

By carefully comparing loan terms and interest rates from multiple lenders, you can find a fixed-term loan that best fits your budget and financial goals. This approach is crucial for successfully managing a large purchase and ensuring a smooth repayment process. Remember to consider your overall financial health and ability to repay the loan before committing.

Not for Regular or Luxury Spending

A personal loan is not a suitable financial tool for covering regular expenses or funding luxury purchases. It’s crucial to remember that personal loans come with interest rates and fees, making them a costly option for everyday spending.

Using a personal loan for non-essential items like vacations or electronics risks accumulating significant debt that could take years to repay. Prioritizing needs over wants is key to responsible personal finance.

Instead of relying on a personal loan for routine expenses, explore budgeting strategies and consider building an emergency fund to handle unexpected costs. This proactive approach will prevent you from falling into the debt cycle.

Similarly, financing luxury items with a personal loan often leads to overspending. The high interest charges can make the initial cost seem deceptively affordable, but the long-term financial implications can be severe. Careful consideration of financial priorities is vital before incurring personal loan debt.

In summary, responsible use of a personal loan focuses on essential expenses and strategic investments that will yield long-term benefits. Avoid the temptation of using it for regular spending or luxury goods.

Borrow Only What You Need

One of the most crucial aspects of securing a personal loan is borrowing only the amount you absolutely require. Avoid the temptation to take out more than necessary, even if the lender offers a higher credit limit. Remember, any additional funds borrowed will accrue interest, increasing your overall repayment burden.

Carefully budget and calculate the precise sum needed to cover your expenses. Creating a detailed breakdown of your planned use of funds will help you determine the minimum loan amount. This approach ensures you borrow responsibly and minimize the long-term financial implications of the loan.

Taking out a larger loan than needed significantly increases your monthly payments and the total interest paid over the loan’s lifespan. This can strain your finances and potentially lead to difficulties in making timely repayments. Prioritize borrowing only what’s essential for your immediate needs and stick to that amount.

Consider the potential consequences of overborrowing. It could affect your credit score, making it harder to secure favorable loan terms or other forms of credit in the future. Responsible borrowing is paramount to maintaining a healthy financial standing.