Considering student loan refinancing? It’s a significant financial decision that could potentially save you thousands of dollars in interest over the life of your loan. Before you jump into the process, however, it’s crucial to understand the nuances involved. This guide will equip you with the essential knowledge to make an informed choice, helping you navigate the complexities of refinancing student loans and determine if it’s the right move for your unique financial situation. We’ll cover key factors like your credit score, interest rates, and the various loan types available to ensure you’re prepared to secure the best possible terms.

Refinancing student loans offers the potential for lower monthly payments, a shorter repayment period, and a lower overall interest rate. However, it’s not always the ideal solution for everyone. Understanding your current loan terms, including your interest rate and remaining balance, is paramount. This article will delve into the implications of refinancing, including the potential loss of federal loan benefits like income-driven repayment plans and forbearance options. We’ll also discuss the importance of comparing offers from multiple lenders to find the most competitive refinancing terms and help you determine if student loan refinancing is the best strategy for your financial goals.

What Is Refinancing and How It Works

Refinancing student loans involves replacing your existing student loan(s) with a new loan from a different lender. This new loan typically comes with different terms, such as a lower interest rate, a different repayment period, or a change in your loan type.

The process begins with applying to a lender. You’ll provide information about your current loans, income, and credit history. The lender will then assess your application and offer you a new loan with specific terms. If you accept the offer, the lender pays off your existing loans, and you begin making payments on the new refinanced loan.

Interest rates are a key factor to consider. Refinancing can be beneficial if you qualify for a lower interest rate than what you currently have. A lower interest rate can significantly reduce the total amount you pay over the life of the loan. However, it’s crucial to compare offers from multiple lenders to ensure you’re getting the best rate possible.

Repayment terms are another important aspect. You might choose a shorter repayment period to pay off your loan faster (resulting in less interest paid overall, but higher monthly payments), or a longer repayment period for lower monthly payments (but ultimately paying more interest over time). Careful consideration of your financial situation is essential when making this decision.

It’s important to understand that refinancing can affect your eligibility for certain federal loan benefits. For example, refinancing federal student loans into a private loan can mean losing access to income-driven repayment plans, deferment options, or forgiveness programs. Carefully weigh the pros and cons before making a decision.

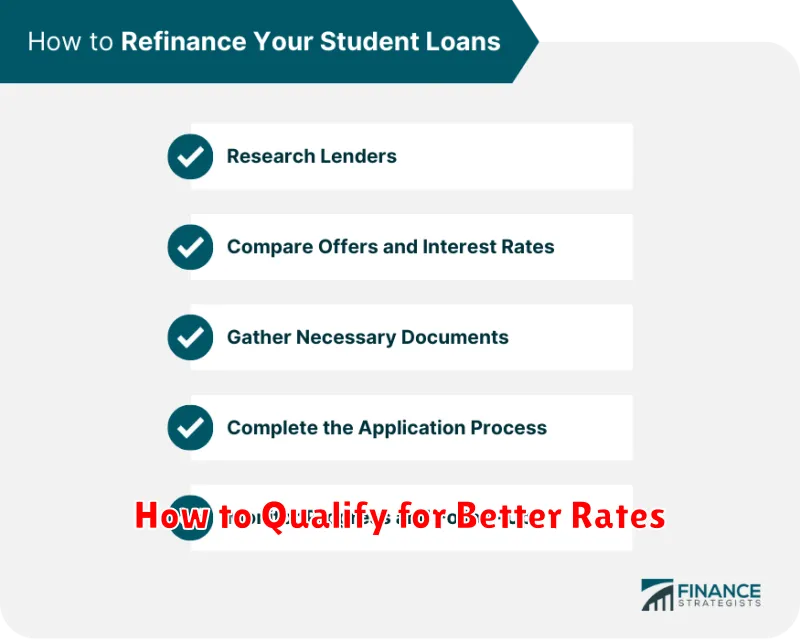

How to Qualify for Better Rates

Securing a lower interest rate on your student loan refinance requires meeting specific criteria set by lenders. Credit score is a paramount factor; a higher score typically translates to more favorable terms. Lenders generally prefer scores above 700, but the specific threshold varies.

Your debt-to-income ratio (DTI) is another key element. This ratio compares your monthly debt payments to your gross monthly income. A lower DTI demonstrates responsible financial management and increases your chances of qualification. Aim for a DTI below 43%, though lenders may have varying requirements.

Income stability is crucial. Lenders want assurance you can consistently make your payments. A steady employment history with a verifiable income source significantly strengthens your application. Consistent income from a reliable source, such as a full-time position, is highly valued.

The type of loan you’re seeking to refinance also plays a role. Federal student loans may have different qualification requirements compared to private loans. Some lenders specialize in specific loan types, influencing the interest rate offered.

Finally, consider your loan amount and loan term. While a larger loan amount might seem daunting, a longer repayment term can lower your monthly payments, potentially improving your DTI and enhancing your chances of approval. However, a longer term will usually lead to paying more in interest over the life of the loan.

Compare Lenders: Terms and Fees

Before you refinance your student loans, it’s crucial to compare offers from multiple lenders. Interest rates vary significantly, and even a small difference can save you thousands of dollars over the life of your loan. Pay close attention to the Annual Percentage Rate (APR), which includes the interest rate and other fees.

Beyond the interest rate, carefully examine all associated fees. Some lenders charge origination fees, which are a percentage of the loan amount. Others may have prepayment penalties if you pay off your loan early. Understand any late payment fees as well, and factor these costs into your decision-making process.

Loan terms also play a vital role. Consider the available repayment periods; a longer term lowers your monthly payment but increases the total interest paid. Conversely, a shorter term increases your monthly payment but reduces the overall interest cost. Carefully weigh your financial situation to determine the optimal balance.

Don’t hesitate to contact lenders directly to clarify any unclear terms or fees. Ask specific questions about their processes, customer service, and repayment options. Gathering this information empowers you to make an informed decision that aligns with your long-term financial goals.

Remember, comparing lenders is a key step in ensuring you secure the best possible refinance terms for your student loans. Take your time, analyze the offers thoroughly, and choose the lender that offers the most favorable combination of interest rates, fees, and repayment options.

Impact on Federal Loan Protections

Refinancing your student loans can significantly impact the federal protections you currently enjoy. Federal student loans offer various benefits unavailable with private loans, including income-driven repayment plans, deferment and forbearance options, and potential loan forgiveness programs such as Public Service Loan Forgiveness (PSLF).

When you refinance federal student loans into a private loan, you lose access to these crucial protections. This means you’ll no longer be eligible for programs designed to manage your payments based on your income or to potentially forgive a portion or all of your debt under specific circumstances. The terms and conditions of your new private loan will dictate your repayment options, which may be less flexible and more stringent.

It’s critical to carefully weigh the benefits of refinancing against the potential loss of these federal protections. Consider your individual financial circumstances, risk tolerance, and long-term financial goals before making a decision. If you anticipate needing flexibility in your repayment plan or are relying on a federal loan forgiveness program, refinancing might not be the best option.

Before refinancing, thoroughly research the terms and conditions of the private loan offer. Pay close attention to the interest rate, repayment period, and any fees involved. Comparing these terms to your current federal loan terms will help you understand the potential financial implications of refinancing and whether it’s a worthwhile decision for your situation.

When to Refinance and When Not To

Refinancing student loans can be a powerful tool for saving money and simplifying your repayment process, but it’s crucial to understand when it’s beneficial and when it’s not. Making the right decision requires careful consideration of your individual financial situation.

Consider refinancing if: You have a significantly improved credit score since you initially took out your loans, resulting in a lower interest rate. Also, if you’ve secured a higher income and can comfortably manage higher monthly payments, a shorter repayment term could save you money on interest over time. Refinancing can also be advantageous if you want to switch from a variable interest rate to a fixed rate to gain stability and predictability in your monthly payments. Finally, if you have multiple loans with different interest rates, refinancing can streamline your payments into a single, potentially lower-rate loan.

Avoid refinancing if: Your credit score is poor or has recently suffered damage, as you may not qualify for favorable interest rates. Similarly, if your income is unstable or declining, you may find it difficult to make higher monthly payments associated with a shorter repayment term. Refinancing may also be detrimental if you are seeking to consolidate federal loans into private loans, as this will result in the loss of key federal benefits such as income-driven repayment plans, deferment, and forbearance options. Furthermore, if your current interest rates are already low, refinancing may not offer enough savings to offset potential fees or drawbacks.

Avoid Mistakes During Application

The student loan refinancing application process, while potentially beneficial, is rife with opportunities for error. Careful attention to detail is crucial to ensure a smooth and successful outcome. One common mistake is inaccurate information. Double-check all provided data, including your Social Security number, date of birth, and employment history, for any inconsistencies or errors. Even a small mistake can significantly delay the processing of your application.

Another critical area to avoid mistakes is in the documentation you submit. Lenders often require specific forms of identification and proof of income. Make sure you gather and submit all necessary documents in a timely manner. Failure to provide the required documentation can lead to application rejection or significant delays. Organize your documents meticulously to ensure a streamlined review process.

Furthermore, it’s vital to understand the terms and conditions of any loan offer. Don’t rush into signing any agreement without carefully reviewing the interest rate, repayment terms, fees, and any other associated costs. Compare offers from multiple lenders to ensure you are getting the most favorable terms. Ignoring these details can result in unfavorable interest rates or hidden fees that will negatively impact your finances over the long term.

Finally, be wary of pre-qualification offers. While these can provide a general idea of your eligibility, they are not a guarantee of approval. Pre-qualification does not consider your full financial picture and thus might lead to unrealistic expectations. Only proceed with a full application after thorough research and consideration.