Choosing between a fixed-rate mortgage and an adjustable-rate mortgage (ARM) is a crucial decision for any prospective homeowner. This choice significantly impacts your monthly payments and overall cost of homeownership over the life of your loan. Understanding the pros and cons of each type is essential to making an informed decision that aligns with your financial goals and risk tolerance. This guide will explore the key differences between fixed-rate and adjustable-rate mortgages, empowering you to select the best option for your specific circumstances.

Fixed-rate mortgages offer predictable monthly payments and long-term stability, providing a sense of security in uncertain economic times. Conversely, adjustable-rate mortgages may offer lower initial interest rates, potentially leading to lower monthly payments in the short term. However, the inherent risk lies in the fluctuating interest rate, which can lead to unpredictable and potentially higher payments in the future. This article will delve into the intricacies of each option, helping you weigh the benefits and drawbacks to determine which mortgage type best suits your needs and long-term financial planning.

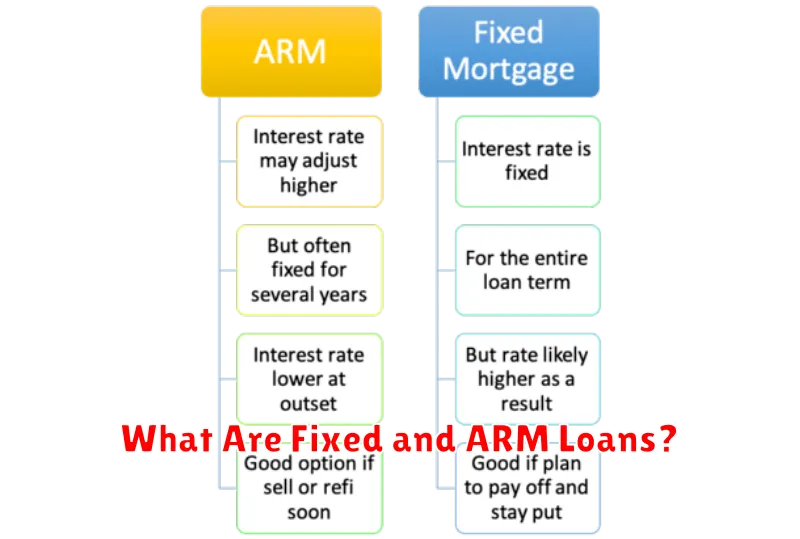

What Are Fixed and ARM Loans?

When choosing a mortgage, one of the most crucial decisions you’ll make is selecting between a fixed-rate mortgage and an adjustable-rate mortgage (ARM). Understanding the key differences between these two loan types is essential for making an informed financial decision.

A fixed-rate mortgage offers a consistent interest rate throughout the entire loan term. This means your monthly payments will remain the same for the life of the loan, providing predictable budgeting and financial planning. The interest rate is set at the time of closing and doesn’t change, regardless of market fluctuations. This stability is a major advantage for many borrowers.

In contrast, an adjustable-rate mortgage (ARM) features an interest rate that changes periodically throughout the loan term. The initial interest rate is typically lower than a fixed-rate mortgage, making it attractive to some borrowers. However, this lower initial rate comes with the risk that your interest rate—and therefore your monthly payments—could increase significantly as the rate adjusts, potentially making your payments unaffordable. The frequency of adjustments (e.g., annually, semi-annually) is specified in the loan terms, along with an index and margin that determine the rate’s fluctuations.

The index is a benchmark interest rate, such as the 1-year Treasury bill rate, which reflects overall market conditions. The margin is a fixed amount added to the index to determine your actual interest rate. Understanding how these components work together is key to understanding the potential risks and rewards of an ARM.

Pros and Cons of Each Type

Choosing between a fixed-rate and an adjustable-rate mortgage (ARM) is a significant financial decision. Each type offers distinct advantages and disadvantages that must be carefully weighed against your individual circumstances and financial goals.

Fixed-Rate Mortgages: These loans offer predictability. The interest rate remains constant throughout the loan term, providing a consistent monthly payment. This stability is highly attractive to many borrowers, allowing them to accurately budget for housing expenses over the long term. A major pro is the peace of mind knowing your monthly payment will not fluctuate due to market changes. However, a con is that fixed-rate mortgages may have higher interest rates than ARMs, particularly if interest rates are low at the time of application. Therefore, the total amount paid over the life of the loan might be higher compared to an ARM.

Adjustable-Rate Mortgages (ARMs): ARMs offer the potential for lower initial interest rates compared to fixed-rate mortgages. This can result in lower monthly payments during the initial period, often referred to as the adjustment period. This can be a significant pro for borrowers who plan to refinance or sell their home before the interest rate adjusts. The primary con is the inherent uncertainty. Interest rates can fluctuate with market conditions, leading to unpredictable monthly payments and the possibility of significantly higher payments in the future. The length of the initial fixed-rate period and the rate adjustment frequency are crucial factors to consider.

How Rate Changes Affect Monthly Payment

Understanding how interest rate changes impact your monthly mortgage payment is crucial when deciding between a fixed-rate and an adjustable-rate mortgage (ARM). A fixed-rate mortgage offers predictable payments throughout the loan term, regardless of market fluctuations. Your monthly payment remains constant, providing budgeting stability.

Conversely, an ARM’s monthly payment is directly affected by changes in the index rate. The index rate, often tied to a benchmark like the London Interbank Offered Rate (LIBOR) or the Secured Overnight Financing Rate (SOFR), fluctuates with broader market conditions. These changes are reflected in your interest rate, and consequently, your monthly payment. Initial interest rates for ARMs are usually lower than fixed-rate mortgages, making them attractive initially.

The frequency of adjustments varies depending on the ARM type. Some ARMs adjust annually, while others might do so monthly or quarterly. Each adjustment period could lead to a change in your monthly payment, either higher or lower, based on the prevailing index rate. It’s important to understand the potential range of these changes and to carefully consider your financial flexibility to manage such variability. An interest rate cap might limit the extent of rate increases, offering some protection against significant payment jumps.

To accurately assess the potential impact, it’s beneficial to use a mortgage calculator that simulates various rate scenarios. By inputting different interest rates, you can visualize how changes would affect your monthly payment over the loan’s lifespan, allowing for informed decision-making. Remember to account for potential rate increases and their cumulative effect on total interest paid.

Understanding your personal financial situation is key. If you anticipate stable income and can tolerate the possibility of payment fluctuations, an ARM might be a suitable option. However, if consistency and predictability are paramount, a fixed-rate mortgage provides greater financial security, even if the initial interest rate is slightly higher.

Choosing Based on Risk Tolerance

A crucial factor in deciding between a fixed-rate and an adjustable-rate mortgage (ARM) is your risk tolerance. This refers to your comfort level with the possibility of experiencing financial losses.

Fixed-rate mortgages offer predictability and stability. Your monthly payment remains constant throughout the loan term, eliminating the uncertainty associated with fluctuating interest rates. This makes them a preferred choice for risk-averse borrowers who prioritize financial security and prefer knowing exactly what their housing costs will be each month.

Conversely, adjustable-rate mortgages carry a higher degree of risk. While they often start with lower interest rates, making them initially more affordable, the interest rate can adjust periodically, potentially leading to higher monthly payments. This fluctuation can be difficult to budget for and is a significant concern for individuals with a low risk tolerance. The potential for larger payments in the future can strain your finances if your income doesn’t increase accordingly.

Consider your financial situation and ability to withstand unexpected increases in your mortgage payment. If you have a stable income and significant savings to act as a buffer against potential rate increases, an ARM might be a viable option. However, if job security is a concern or if you prefer consistent payments, a fixed-rate mortgage offers greater peace of mind.

Ultimately, the best choice depends on your individual circumstances and how much risk you are willing to accept. Carefully assess your personal financial stability and future income expectations before making a decision.

How Long You Plan to Stay

One of the most crucial factors in deciding between a fixed-rate and an adjustable-rate mortgage (ARM) is how long you intend to live in your home. This significantly impacts the potential benefits and risks associated with each type of loan.

Fixed-rate mortgages offer predictable monthly payments and interest rates throughout the loan term. This stability is ideal for homeowners who plan to stay in their homes for a significant period, such as 15 or 30 years. The predictability allows for better budgeting and financial planning.

Conversely, adjustable-rate mortgages typically start with lower interest rates than fixed-rate loans. This can result in lower initial monthly payments, making them attractive to those planning to sell or refinance their home within a shorter timeframe, such as five to seven years. However, the interest rate adjusts periodically based on market conditions, leading to potential increases in monthly payments that could become financially burdensome if the homeowner isn’t prepared.

If you anticipate selling or refinancing your home before the initial low-rate period of an ARM expires, the lower initial payments might outweigh the potential risks of future rate increases. However, if you plan on staying in your home for a longer period, the long-term stability of a fixed-rate mortgage generally offers greater financial security.

Therefore, carefully considering your projected homeownership timeline is critical in making an informed decision between a fixed-rate and adjustable-rate mortgage. This assessment should be combined with your risk tolerance and overall financial goals.

Estimate Long-Term Cost of Each

To make an informed decision between a fixed-rate and an adjustable-rate mortgage (ARM), it’s crucial to estimate the total long-term cost of each option. This goes beyond simply comparing the initial interest rates.

For a fixed-rate mortgage, the calculation is relatively straightforward. You’ll know the interest rate and loan term upfront, allowing you to easily determine the total interest paid over the life of the loan using a mortgage calculator or amortization schedule. This provides a clear picture of your total repayment cost.

Adjustable-rate mortgages present a more complex calculation. Their interest rates fluctuate based on an index, typically adjusted periodically (e.g., annually). To estimate the long-term cost, you need to consider potential future interest rate scenarios. You can use online calculators that allow for inputting various interest rate projections over the loan term. It’s also advisable to consider worst-case scenarios where interest rates rise significantly.

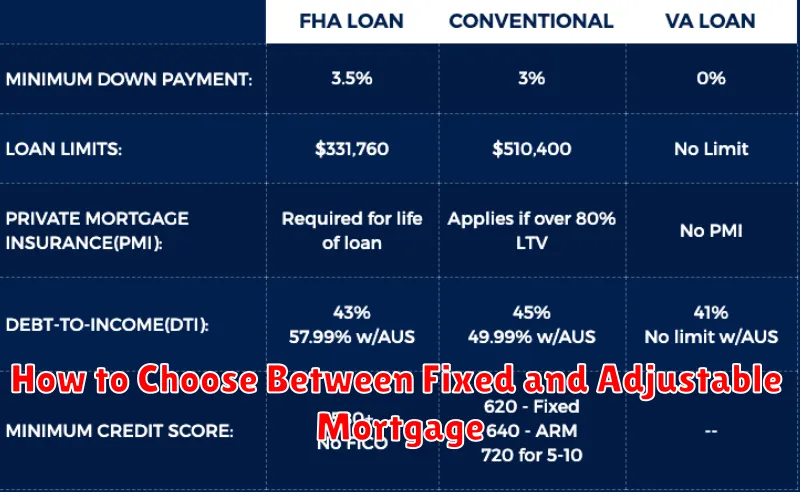

Remember to factor in all associated costs. This includes not only interest payments but also closing costs, potential prepayment penalties (if applicable), and private mortgage insurance (PMI) if your down payment is less than 20%. These additional expenses can significantly influence the overall cost of each mortgage type over the long run.

By carefully estimating the total cost of each option, you can gain a clearer understanding of which mortgage best aligns with your financial situation and long-term goals, helping you make a more financially responsible choice.