Securing the right equipment financing can be crucial for the success of any business. Whether you’re a small startup needing initial business loans or an established enterprise looking to upgrade machinery and technology, understanding your options is paramount. This article will explore the various ways business loans can be leveraged for effective equipment financing, helping you navigate the process and make informed decisions to optimize your investment and fuel business growth.

From understanding different types of loans and their associated interest rates to determining the best repayment schedule for your business, effective equipment financing requires careful planning. We’ll delve into the advantages of using business loans for purchasing vital equipment, such as improved cash flow, tax benefits, and the potential for increased productivity and profitability. Learn how to choose the right loan to acquire the assets your company needs to thrive, minimizing financial risk and maximizing return on investment.

When to Finance Equipment Purchases

The decision of whether or not to finance an equipment purchase is a crucial one for any business. It involves weighing the immediate costs against the long-term benefits and considering your financial health. Timing is a significant factor.

One key indicator is the size of the purchase. Large equipment purchases that would severely strain your cash flow are prime candidates for financing. This allows you to maintain operational liquidity while acquiring necessary assets. Smaller purchases, on the other hand, may be more easily handled with outright cash payment, depending on your financial position.

Another factor to consider is the equipment’s lifespan and return on investment (ROI). If the equipment is expected to generate significant revenue over an extended period, financing can be a strategic move. The payments can be offset by the increased profitability, making the investment worthwhile. Conversely, if the equipment has a short lifespan or limited ROI, financing might not be the most efficient option.

Tax implications are also crucial. Depending on your jurisdiction, leasing or financing equipment may offer tax advantages that can offset the cost of borrowing. Consult with a tax professional to determine the best approach for your specific circumstances.

Finally, assess your overall financial stability. Before considering financing, review your credit score, cash reserves, and debt-to-income ratio. A strong financial foundation will make securing favorable financing terms significantly easier. Poor credit may lead to higher interest rates or even loan rejection.

Loan vs Lease: Which Is Better?

When financing equipment for your business, you’ll face a critical decision: should you take out a loan or lease the equipment? Both options offer distinct advantages and disadvantages, and the best choice depends heavily on your specific business circumstances and financial goals.

A loan allows you to purchase the equipment outright. Once the loan is repaid, you own the asset. This offers significant long-term benefits, including ownership and potential resale value. However, loans typically require a larger upfront down payment and involve higher monthly payments compared to leasing. You are also responsible for maintenance and repairs throughout the equipment’s lifespan.

Conversely, a lease involves renting the equipment for a predetermined period. Monthly payments are generally lower than loan payments, making it a more affordable option, particularly for businesses with tighter budgets. Leases often include maintenance and repair coverage, reducing your operational expenses. However, at the end of the lease term, you don’t own the equipment, and you’ll need to return it or enter into a new lease agreement. This lack of ownership can limit flexibility and hinder potential resale value.

Key factors to consider when choosing between a loan and a lease include the length of time you anticipate needing the equipment, your budget, your company’s financial health, and the anticipated maintenance costs. A longer-term need usually favors a loan, while a shorter-term need might make leasing more attractive. Analyzing your cash flow projections and consulting with a financial advisor can help you determine the most financially sound decision for your business.

Expected Lifespan of Equipment

Understanding the expected lifespan of your equipment is crucial when securing a business loan for financing. Lenders will carefully consider this factor, as it directly impacts the repayment plan and the overall risk assessment of your loan application. A shorter lifespan necessitates faster repayment or a higher initial investment.

The useful life of equipment varies significantly depending on several factors. Type of equipment plays a significant role; for example, a heavy-duty industrial machine might have a longer lifespan than a standard office computer. Maintenance practices also contribute substantially. Regular maintenance and servicing can prolong the life of your equipment, reducing the risk of premature failure and extending its useful life.

Industry standards often provide guidelines for the typical lifespan of specific types of equipment. Researching these industry standards can help you accurately estimate the expected lifespan of your intended purchase. Consulting with equipment suppliers or industry professionals can also provide valuable insight into realistic expectations. You should also factor in potential obsolescence; rapid technological advancements can render even relatively new equipment outdated.

Accurate estimation of equipment lifespan is essential for creating a realistic financial projection. This projection is a cornerstone of your loan application. Underestimating the lifespan could lead to insufficient time to repay the loan, while overestimating could result in unnecessary debt burden during the equipment’s operational life.

Therefore, before applying for a business loan, carefully research and document the expected lifespan of your intended equipment. This demonstration of due diligence will strengthen your loan application and help secure the necessary funding.

How to Match Loan Term to Usage

Matching the loan term to the useful life of the financed equipment is crucial for effective equipment financing. A mismatched loan term can lead to unnecessary financial burdens or premature disposal of assets.

For equipment with a short useful life, such as certain types of technology or fast-depreciating tools, a shorter loan term is generally recommended. This minimizes interest payments and aligns the loan repayment with the asset’s operational lifespan. A shorter term might mean higher monthly payments, but the overall cost may be less.

Conversely, equipment with a long useful life, like heavy machinery or long-lasting industrial equipment, is better suited to a longer loan term. This lowers the monthly payments, making them more manageable for your business cash flow. However, it’s important to consider the total interest paid over the life of the loan.

Consider depreciation. The rate at which your equipment depreciates should factor into your loan term decision. If an asset depreciates rapidly, a shorter loan term mitigates the risk of being stuck with a depreciated asset and a large outstanding loan balance.

Assess your business’s cash flow. Your business’s ability to comfortably handle monthly payments influences the optimal loan term. While a longer term may seem attractive due to lower monthly payments, it increases the total interest paid. A shorter term might strain cash flow initially but ultimately reduce the overall borrowing cost.

Analyze industry standards. Examining common loan terms for similar equipment within your industry can provide valuable insight. This helps you understand market expectations and determine a realistic and appropriate loan duration.

Ultimately, the ideal loan term is a balance between manageable monthly payments and minimizing the total interest paid over the life of the loan. Careful consideration of the equipment’s useful life, depreciation rate, and your business’s financial capabilities is vital in making this crucial decision.

Tax Benefits of Loan-Financed Equipment

Financing equipment purchases through business loans offers several significant tax advantages that can positively impact your company’s bottom line. Understanding these benefits is crucial for maximizing your return on investment.

One key advantage is the ability to deduct interest payments on your business loan. These interest expenses are typically deductible as a business expense, reducing your taxable income and your overall tax liability. The amount of the deduction will depend on factors such as the loan amount, interest rate, and the loan’s repayment schedule. Consult with a tax professional to accurately determine your deduction.

Furthermore, the depreciation of the financed equipment itself can provide substantial tax savings. Depreciation allows businesses to deduct a portion of the equipment’s cost each year over its useful life, rather than deducting the entire cost in the year of purchase. This gradual deduction helps to spread out the tax benefits over several years, providing consistent tax relief. The specific depreciation method used will depend on factors such as the type of equipment and the applicable tax regulations.

Section 179 expensing, in certain circumstances, allows businesses to deduct the full cost of qualifying equipment in the year it’s placed in service. This can significantly reduce your tax burden in the initial year of purchase, offering immediate financial relief. Eligibility for Section 179 expensing is subject to annual limits, and it’s vital to check current IRS regulations to determine eligibility for your specific situation.

Finally, remember that tax laws are subject to change. It’s essential to keep abreast of current tax regulations and consult with a qualified tax advisor to ensure you are maximizing your tax benefits and complying with all applicable laws. They can provide tailored advice based on your specific business circumstances and chosen financing methods.

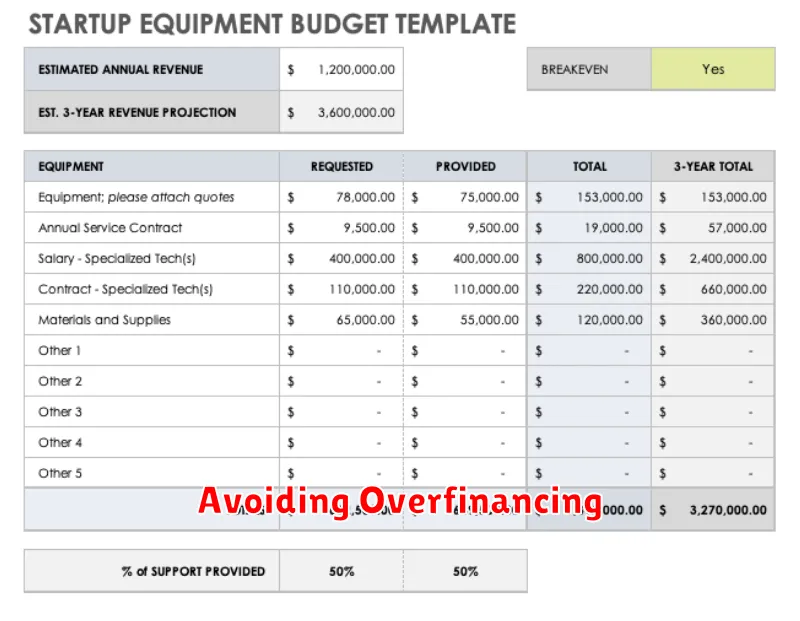

Avoiding Overfinancing

One of the most crucial aspects of securing a business loan for equipment financing is avoiding overfinancing. Taking out a loan for more than the actual cost of the equipment, including any necessary installation or setup fees, can lead to significant financial strain.

Overfinancing often results in higher interest payments over the loan’s lifetime. This is because you’re paying interest not only on the equipment’s cost but also on the extra borrowed amount. This excess interest can dramatically impact your profitability and cash flow, potentially hindering your business’s growth and stability.

To avoid this pitfall, meticulously budget for the total cost of the equipment. Include all associated expenses, such as delivery charges, permits, taxes, and any necessary modifications or customizations. Only then should you determine the appropriate loan amount.

Shop around for the best loan terms and interest rates to minimize the overall cost of financing. Compare offers from multiple lenders to secure the most advantageous deal. Consider the loan’s repayment schedule and its alignment with your projected cash flow to ensure manageable monthly payments.

Finally, it’s advisable to consult with a financial advisor. They can offer expert guidance on determining the optimal loan amount and structuring your financing to best suit your business’s financial needs and long-term goals. Their input can help you navigate the complexities of equipment financing and avoid the risks associated with overfinancing.