Understanding your credit card limit is crucial for effective financial management. A higher limit can offer greater flexibility, but it’s essential to know what factors influence this critical number. This article delves into the key elements that lenders consider when determining your credit card limit, including your credit score, income, and existing debt. Learn how these, and other factors, affect your borrowing power and how you can potentially increase your credit limit.

From your credit history to your debt-to-income ratio, numerous variables contribute to the credit card limit assigned by financial institutions. We will explore the nuances of each factor, offering practical insights and actionable advice to help you navigate the complexities of credit card approvals and limit determinations. By understanding the interplay of these elements, you can take proactive steps to improve your chances of obtaining a higher credit limit and optimize your overall financial health.

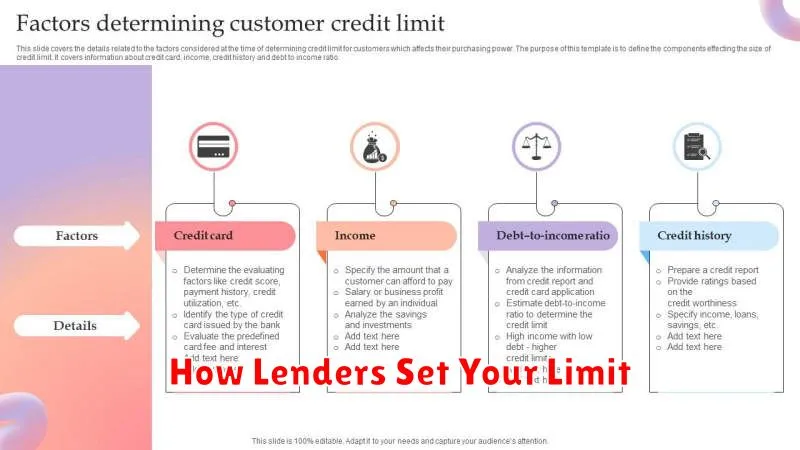

How Lenders Set Your Limit

The credit limit assigned to your credit card is a crucial factor determining your spending power. Lenders use a complex algorithm considering various financial factors to establish this limit. This process isn’t arbitrary; it’s a risk assessment designed to protect both the lender and the borrower.

One of the most significant factors is your credit score. A higher credit score, indicating a history of responsible credit management, typically results in a higher credit limit. Conversely, a low credit score suggests a higher risk of default, leading to a lower limit or even rejection of your application.

Your income also plays a significant role. Lenders assess your ability to repay the debt based on your income. A higher income demonstrates a greater capacity to manage debt, often leading to a higher approved credit limit.

Your debt-to-income ratio (DTI) is another critical element. This ratio compares your monthly debt payments to your monthly income. A lower DTI indicates less financial strain and a lower risk to the lender, potentially resulting in a higher credit limit.

Existing credit accounts and their utilization are also considered. Having multiple credit cards with high balances can negatively impact your credit limit approval, while a history of responsible credit card use across multiple accounts can often lead to a higher limit.

Finally, the type of credit card you apply for influences the offered limit. Premium cards generally require higher credit scores and often come with higher credit limits than basic cards.

In essence, lenders use a multifaceted approach to determine your credit limit. It is a dynamic process that adapts to your changing financial circumstances over time. Understanding these factors can help you improve your chances of obtaining a higher credit limit in the future.

Income, Credit Score, and History

Your income plays a significant role in determining your credit card limit. Lenders assess your ability to repay debt, and a higher income demonstrates a greater capacity to manage monthly payments. Credit card companies typically prefer applicants with a stable income history, showing consistent earnings over time.

Your credit score is another crucial factor. A higher credit score indicates a lower risk to the lender. Lenders use credit scores to evaluate your creditworthiness, considering factors like your payment history, outstanding debt, and length of credit history. A strong credit score can significantly influence the credit limit offered, potentially leading to higher approval amounts.

Your credit history, encompassing the length of your credit history and the responsible use of existing credit, is closely examined. A longer history, demonstrating consistent on-time payments and responsible credit management, reflects positively on your application. Conversely, a short credit history or a history marred by late or missed payments will often result in a lower credit limit or even denial of the application.

The interplay of these three factors — income, credit score, and credit history — creates a comprehensive profile used by lenders to determine your creditworthiness and subsequently, your credit card limit. A strong showing in all three areas significantly increases the likelihood of receiving a higher credit limit.

Can You Request a Higher Limit?

Yes, you can typically request a higher credit card limit from your issuer. This is often referred to as a credit limit increase. The process usually involves contacting your credit card company directly, either by phone or through their online portal. Many issuers have online applications that allow you to submit a request for an increase quickly and easily.

Approval of your request depends on several factors, most importantly your creditworthiness. The issuer will review your credit report and score, considering elements like your payment history, credit utilization, and overall debt burden. A strong credit history with a consistent record of on-time payments significantly increases your chances of approval. Similarly, a low credit utilization ratio (the amount of credit you use compared to your available credit) demonstrates responsible credit management and improves your likelihood of success.

Length of account history also plays a role. Issuers are generally more willing to increase limits for accounts that have been open for a longer period and have consistently demonstrated responsible use. Recent applications for new credit may negatively impact your chances, as it can signify increased risk for the issuer.

In addition to your credit history, your income and employment stability are often considered. Providing proof of income and employment can strengthen your application. Some issuers may also assess factors like your age and the type of credit card you possess. A premium card, for example, may allow for a higher credit limit compared to a standard card.

It’s important to understand that a credit limit increase is not guaranteed, even with a strong credit profile. Issuers use various internal scoring models and risk assessment methods to determine whether to grant a request. If your request is denied, the issuer may provide reasons for the decision, which can help you understand areas for improvement in your credit health.

Risks of High Credit Limits

While a high credit limit can seem advantageous, offering greater spending flexibility, it also presents several significant risks. The most immediate danger is the temptation to overspend. A larger limit can easily lead to accumulating substantial debt, especially if spending habits aren’t carefully managed.

Another key risk is the potential impact on your credit score. Although a high limit can positively influence your credit utilization ratio (the percentage of your available credit you’re using), consistently using a large portion of your available credit can negatively affect your score. Aiming for a credit utilization ratio below 30% is generally recommended.

High credit limits can also increase your financial vulnerability. If you lose your job or experience unexpected expenses, a larger outstanding balance becomes more difficult to manage and can result in significant financial strain. The higher the limit, the greater the potential for accumulating debt that can be challenging to repay.

Furthermore, a higher credit limit might lead to increased interest payments. Even if you pay your balance in full each month, the potential for accumulating interest charges increases with a larger limit, especially if you’re using a significant portion of your available credit. Careful budgeting and responsible spending are crucial to mitigating this risk.

Finally, consider the psychological impact. Having a large credit limit might instill a false sense of security, leading to impulsive purchases and a less cautious approach to spending. This can contribute to unsustainable debt levels and long-term financial difficulties.

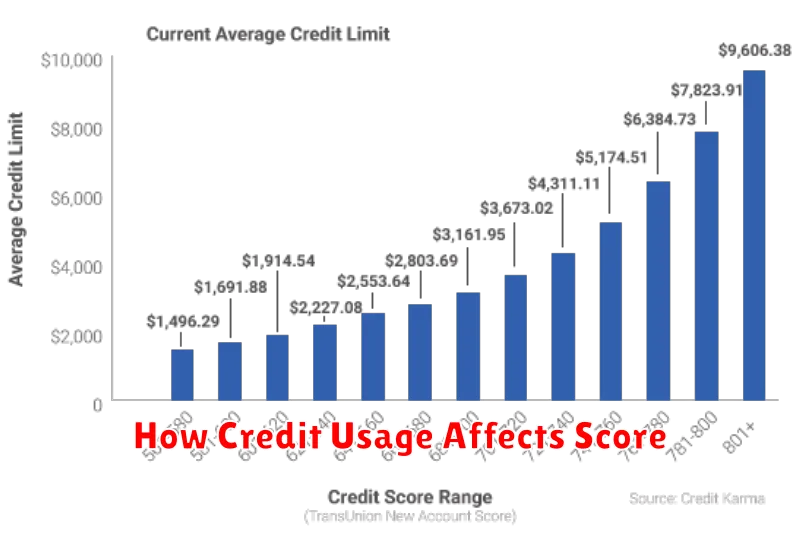

How Credit Usage Affects Score

Your credit utilization ratio, or the percentage of your available credit you’re using, is a significant factor in your credit score. Lenders closely examine this ratio because it reflects your ability to manage debt responsibly.

Keeping your credit utilization low is crucial. Ideally, you should aim to keep your credit utilization ratio below 30%. The lower, the better. A ratio of 10% or less is considered excellent. A higher ratio suggests potential overspending and increased risk to lenders.

High credit utilization can negatively impact your credit score in several ways. It signals to lenders that you might be struggling financially, increasing the likelihood of missed payments. It also indicates a greater reliance on credit, which can be a warning sign.

Conversely, maintaining a low credit utilization ratio demonstrates responsible financial behavior. It shows lenders that you can manage your credit effectively and are less likely to default on your payments. This positive impression can lead to improved credit scores and potentially more favorable credit terms in the future.

It’s important to note that credit utilization is calculated separately for each credit card and also as a total across all your credit cards. Therefore, monitoring both individual card usage and your overall credit utilization is essential for maintaining a strong credit score.

Best Practices for Limit Management

Effectively managing your credit card limits is crucial for maintaining a healthy credit score and avoiding financial strain. Understanding your spending habits and aligning your credit limit with them is key.

One of the best practices is to request a credit limit increase only when you have a demonstrable need and a strong track record of responsible credit use. This shows lenders you can manage higher credit responsibly.

It’s important to keep your credit utilization low. Aim for keeping your credit utilization ratio (the amount you owe compared to your total credit limit) below 30%, ideally much lower. A lower ratio signifies responsible credit management to lenders.

Regularly monitor your credit report for any discrepancies or errors. This proactive approach helps you identify potential issues early on and take corrective action to protect your credit health and your credit limit.

Avoid applying for multiple credit cards within a short period. Each application results in a hard inquiry on your credit report, potentially impacting your credit score and possibly hindering your ability to increase your credit limits in the future.

Pay your bills on time, every time. Late payments negatively impact your credit score and can lead to reduced credit limits or even account closures. Consistent on-time payments demonstrate responsible credit behavior.

Understand the implications of a high credit limit. While a high limit might seem appealing, it can also tempt you to overspend. Manage your spending carefully, regardless of your credit limit.

Finally, consider your overall financial situation. A credit limit should be a tool to support your financial goals, not a burden. Ensure your spending habits align with your income and debt management plan.