Understanding your credit card utilization ratio is crucial for maintaining a healthy credit score. This seemingly simple calculation – the percentage of your total available credit you’re currently using – significantly impacts your creditworthiness. A high utilization ratio can negatively affect your credit report, leading to higher interest rates on loans and even impacting your ability to secure future credit. This article will delve into the intricacies of credit utilization, explaining how it’s calculated, why it matters, and most importantly, how you can strategically manage it to optimize your financial health and achieve a better credit rating.

Many factors influence your credit score, but credit utilization is a particularly powerful one. Lenders closely monitor this ratio as it’s a strong indicator of your ability to manage debt. By learning how to effectively manage your credit card debt and keep your utilization low, you can positively impact your FICO score and access better financial opportunities. This guide will provide you with clear, actionable strategies to lower your credit card utilization, improving your overall financial standing and securing a brighter financial future. We will cover everything from understanding your credit limits to developing effective budgeting techniques.

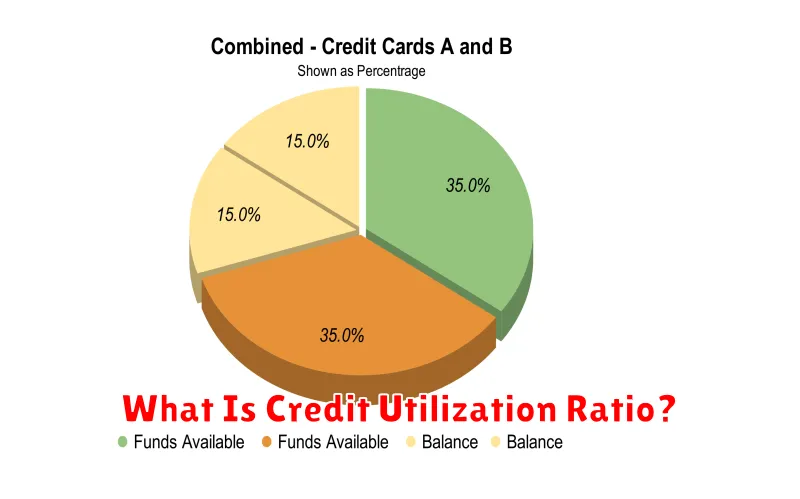

What Is Credit Utilization Ratio?

Your credit utilization ratio is a crucial metric that significantly impacts your credit score. It represents the percentage of your total available credit that you’re currently using. This is calculated by dividing your total credit card balances by your total credit limit.

For example, if you have a total credit limit of $10,000 across all your credit cards and you currently owe $3,000, your credit utilization ratio is 30% ($3,000 / $10,000 = 0.30 or 30%). This seemingly simple calculation holds considerable weight in determining your creditworthiness.

Understanding this ratio is vital because credit bureaus consider it a key indicator of your financial responsibility. A high credit utilization ratio suggests you may be overextending your credit, potentially increasing the risk of default. Conversely, a low ratio demonstrates responsible credit management and financial discipline.

It’s important to note that the calculation considers the total available credit across all your credit cards, not just individual card limits. Even if you pay off one card completely, if your utilization on other cards remains high, your overall ratio remains affected.

Keeping your credit utilization low, ideally below 30%, is generally recommended for maintaining a healthy credit score. Strive for an even lower ratio – under 10% – for optimal credit health. Monitoring and managing your credit utilization is a key step in building and preserving a strong credit profile.

How It Affects Credit Score

Your credit utilization ratio, or the percentage of your available credit you’re using, is a significant factor influencing your credit score. Lenders view a high utilization ratio as a red flag, suggesting you may be struggling to manage your finances.

Credit scoring models generally penalize high utilization rates. A utilization rate above 30% is often considered risky, while rates exceeding 50% can significantly damage your credit score. Conversely, keeping your utilization rate low, ideally below 10%, demonstrates responsible credit management and can contribute to a higher credit score.

The impact of utilization on your score isn’t solely determined by the percentage itself; the number of accounts you have also plays a role. A single high-utilization account will have a more detrimental effect than several accounts each with low utilization. Therefore, maintaining low utilization across all your accounts is crucial for optimal credit health.

Improving your credit utilization ratio is relatively straightforward. You can pay down outstanding balances to reduce your utilization percentage. Alternatively, increasing your available credit by applying for a new credit card or requesting a credit limit increase on existing cards (if approved) can also lower your utilization ratio. However, it’s important to note that applying for new credit can temporarily affect your score. Carefully weigh the potential benefits and drawbacks before applying for more credit.

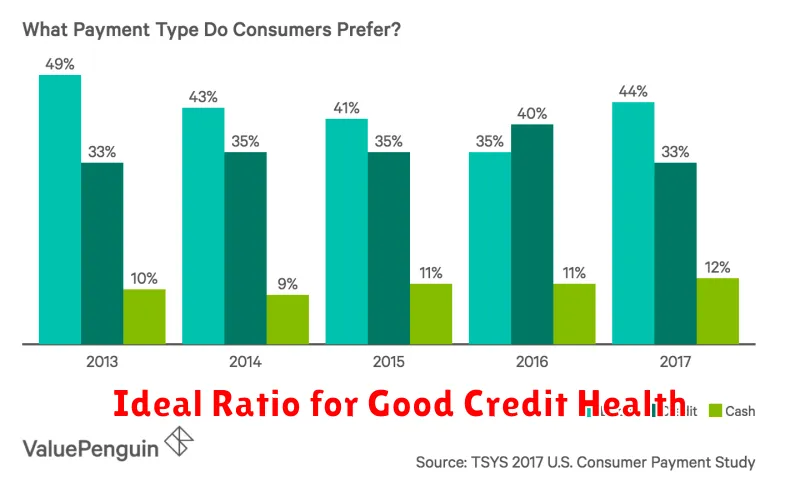

Ideal Ratio for Good Credit Health

Maintaining a healthy credit score is crucial for securing loans, renting an apartment, or even getting a job. A significant factor influencing your credit score is your credit utilization ratio, which represents the percentage of your available credit you’re currently using.

Experts generally agree that keeping your credit utilization ratio below 30% is ideal. This signifies responsible credit management and demonstrates to lenders that you’re not overextending yourself financially. Aiming for a ratio even lower, such as under 10%, can further boost your credit score.

However, the impact of credit utilization on your score isn’t a simple linear relationship. While exceeding 30% can negatively affect your score, exceeding 50% or even 70% can have a much more pronounced negative impact. Lenders view higher utilization ratios as a higher risk.

It’s important to remember that your credit utilization ratio is calculated separately for each credit card and then considered as a whole across all your accounts. Therefore, keeping balances low across all your cards is essential for maintaining a healthy ratio. Regularly monitoring your credit reports and making timely payments are also key components of maintaining good credit health.

While the 30% rule is a useful guideline, individual circumstances might necessitate a slightly higher ratio. However, consistently staying below this benchmark, and ideally aiming for a lower percentage, significantly improves the likelihood of securing favorable credit terms in the future.

Why 0% Is Not Always Best

While a 0% APR (Annual Percentage Rate) on a credit card sounds incredibly appealing, it’s crucial to understand that it’s not always the optimal choice. The seemingly perfect deal often comes with caveats that can negatively impact your credit score and financial health if not carefully considered.

One significant factor is the introductory period. These 0% APR offers typically last for a limited time, often ranging from 6 to 18 months. Failing to pay off the balance in full before the promotional period expires can result in a significant interest charge, potentially exceeding the interest you would have paid on a card with a higher, but fixed, APR.

Furthermore, fees associated with 0% APR cards can sometimes offset the benefits of the interest-free period. Balance transfer fees, annual fees, or other charges can quickly eat into any savings you might have gained from avoiding interest payments. Carefully evaluate all fees before committing to a 0% APR card.

Finally, a relentless focus on a 0% APR card can overshadow the importance of responsible credit card management. While aiming for a zero balance is a smart financial goal, utilizing credit responsibly, paying on time, and maintaining a low credit utilization ratio are equally, if not more, important for building a strong credit history. Prioritizing these elements can have a far greater long-term impact than a temporary 0% APR offer.

Tips to Lower Your Ratio

Maintaining a low credit utilization ratio is crucial for a strong credit score. This ratio, representing the percentage of your available credit you’re using, significantly impacts your creditworthiness. Fortunately, there are several actionable steps you can take to lower your ratio and improve your financial standing.

One of the most effective strategies is to pay down your credit card balances. Even small, consistent payments can make a noticeable difference over time. Prioritize high-interest cards first to minimize interest charges while reducing your overall debt. Consider creating a budget to track your spending and allocate funds specifically for debt repayment.

Another impactful approach involves increasing your available credit. You can achieve this by requesting a credit limit increase from your existing credit card issuers. Before requesting an increase, ensure you have a good payment history and a manageable debt-to-income ratio. Alternatively, you could apply for a new credit card with a higher credit limit, but be cautious about opening too many accounts in a short period.

Responsible spending habits are paramount. Carefully track your expenses to avoid exceeding your credit limits. Develop a mindful spending plan that aligns with your income and financial goals. Avoiding impulsive purchases and sticking to your budget are key components of managing credit effectively.

Finally, remember that consistent on-time payments are vital. Late payments negatively impact your credit score and can hinder your efforts to lower your utilization ratio. Set up automatic payments or reminders to ensure timely repayments. Consistent responsible behavior demonstrates financial reliability to lenders, improving your creditworthiness in the long run.

Monitor Usage With Alerts

Effectively managing your credit card utilization requires consistent monitoring. Regularly checking your credit card statements and online account provides valuable insight into your spending habits and overall credit card usage.

To enhance this monitoring process, consider setting up spending alerts. Many credit card companies offer this feature, allowing you to receive notifications via email or text message when your spending reaches a pre-defined threshold. This can be a particularly useful tool for preventing unexpected overspending and maintaining a healthy credit utilization ratio.

Automatic payment reminders are another beneficial feature to consider. These alerts ensure you don’t miss payments, which can negatively impact your credit score. Missed payments can significantly increase your utilization ratio, especially if the payment is significantly late.

By leveraging these alert systems, you gain proactive control over your credit card usage and improve your ability to maintain a low credit utilization ratio, ultimately contributing to a stronger credit profile.

Remember to customize your alert settings to reflect your individual spending patterns and financial goals. Setting alerts at different spending levels can provide further granularity in managing your expenses.