Securing a business loan can be a pivotal step in your company’s growth trajectory, unlocking opportunities for expansion, equipment upgrades, or navigating financial challenges. However, the application process can be intricate and demanding, requiring meticulous preparation to maximize your chances of approval. This comprehensive checklist before applying for a business loan will guide you through the essential steps, ensuring you present a compelling case to lenders and significantly increase your likelihood of securing the funding you need.

Before you even begin filling out loan applications, it’s crucial to undertake thorough financial planning and assess your creditworthiness. This checklist will cover key aspects such as preparing detailed financial statements, understanding your credit score and report, outlining a comprehensive business plan, and identifying the most suitable loan type for your specific needs. Ignoring these preliminary steps can lead to delays, rejection, or even unfavorable loan terms. Let’s ensure you are fully prepared to present a strong, persuasive application that will impress potential lenders and secure the financing your business deserves.

Clarify the Purpose of the Loan

Before you even begin the application process, it’s crucial to clearly define the purpose of your business loan. This isn’t simply about stating you need money; lenders require a specific and detailed explanation.

Will the loan fund equipment purchases? Inventory expansion? Marketing campaigns? Renovations? Hiring? Debt consolidation? Be precise. The more detail you provide, the stronger your application will be.

Your stated purpose should be directly tied to achieving a specific business goal. For example, instead of saying “to improve the business,” you might say “to purchase a new milling machine that will increase production by 20% and allow us to take on larger contracts.” This demonstrates a clear connection between the loan and a measurable outcome.

Clearly articulating the purpose allows lenders to assess the viability and risk associated with your request. A well-defined purpose showcases your preparedness and understanding of your business needs, significantly increasing your chances of approval.

Furthermore, having a clear purpose helps you budget effectively and track your progress after receiving the loan. This demonstrates financial responsibility to your lender and ensures you use the funds as intended.

Prepare Key Financial Documents

Securing a business loan hinges on your ability to present a compelling financial picture to potential lenders. Therefore, meticulously preparing key financial documents is crucial. Thoroughness and accuracy are paramount in this stage.

The specific documents required may vary depending on the lender and the loan amount, but some common necessities include: profit and loss statements (showing income and expenses over a period of time), balance sheets (demonstrating assets, liabilities, and equity at a specific point in time), and cash flow statements (illustrating the movement of cash within your business). These documents should cover at least the past two to three years, and ideally longer if available.

Beyond these core statements, lenders often request additional documentation such as tax returns (demonstrating your tax compliance and financial history), bank statements (showing your financial transactions and account balances), and potentially invoices and receipts (verifying transactions and expenses). Having these readily available significantly streamlines the application process.

It is advisable to organize these documents into a clear and concise format, ideally bound together in a professional manner. This demonstrates attention to detail and organizational skills, qualities lenders value highly. Consider using a binder or creating a digital portfolio for easy access and presentation. Remember to maintain the confidentiality of sensitive financial information.

Finally, review all documentation meticulously before submitting it. Ensure all figures are accurate and consistent across different documents. Any inaccuracies can severely impact your chances of loan approval. Consider having an accountant or financial professional review your documents before submission for a second opinion.

Know Your Credit Score

Before applying for a business loan, understanding your credit score is paramount. Your credit score is a numerical representation of your creditworthiness, reflecting your history of borrowing and repayment. Lenders use this score to assess the risk associated with lending you money.

A higher credit score generally indicates a lower risk to lenders, leading to more favorable loan terms, such as lower interest rates and potentially higher loan amounts. Conversely, a lower credit score might result in higher interest rates, smaller loan amounts, or even loan rejection. Therefore, knowing your score beforehand allows you to gauge your eligibility and prepare accordingly.

You can obtain your credit report and score from various credit bureaus such as Equifax, Experian, and TransUnion. Reviewing your report for any errors is crucial, as inaccurate information can negatively impact your score. Addressing any discrepancies promptly can improve your chances of securing a loan with favorable terms.

It’s important to note that different lenders may use different scoring models and weigh various factors differently. While your credit score is a significant factor, lenders also consider other aspects of your business and financial situation, such as your business plan, revenue, and cash flow. Therefore, while knowing your credit score is essential, it’s just one piece of the puzzle in the business loan application process.

Build a Solid Repayment Plan

Before applying for a business loan, crafting a robust repayment plan is crucial. Lenders want to see a clear demonstration of your ability to manage debt and ensure timely repayments. A well-structured plan significantly increases your chances of loan approval.

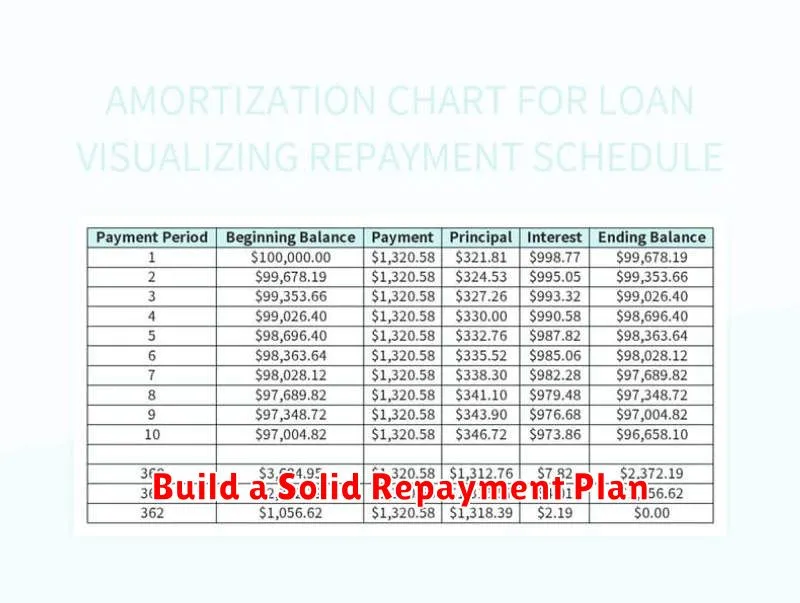

Your repayment plan should explicitly outline a realistic timeline for repayment. This includes specifying the amount you’ll pay each month or at designated intervals and the total duration of the loan repayment period. Be precise; avoid vague promises.

Demonstrate a deep understanding of your cash flow. Include detailed projections illustrating how you will generate sufficient revenue to cover loan repayments while maintaining the financial health of your business. Conservative estimates are preferred over overly optimistic projections.

Consider exploring different repayment structures, such as amortized loans or balloon payments, to determine the most suitable option given your business’s financial circumstances. Clearly articulate the chosen structure and its implications within your plan.

It is vital to be completely transparent about your existing debt obligations. This demonstrates financial responsibility and allows lenders to assess your overall debt capacity. Failing to disclose this information could significantly hinder your application.

Finally, make your repayment plan a comprehensive and well-organized document. Use clear language, avoid technical jargon, and present the information in a visually appealing and easy-to-understand manner. A professional presentation can significantly enhance the credibility of your application.

Compare Multiple Lenders and Offers

Before committing to a business loan, it’s crucial to compare offers from multiple lenders. This ensures you secure the most favorable terms and interest rates for your specific needs.

Consider a range of lenders, including banks, credit unions, and online lenders. Each institution may have different lending criteria, interest rates, fees, and repayment options.

Pay close attention to the Annual Percentage Rate (APR). This reflects the total cost of the loan, including interest and fees. A lower APR is generally more desirable.

Examine the loan terms carefully. Understand the repayment schedule, the length of the loan, and any prepayment penalties. Compare the total amount you’ll repay over the life of the loan.

Don’t hesitate to negotiate with lenders. Many are willing to adjust terms to secure your business as a client. This could involve negotiating a lower interest rate or more favorable repayment schedule.

Finally, ensure you fully understand all fees associated with the loan, including origination fees, application fees, and late payment fees. These can significantly impact the overall cost.

Understand All Loan Terms

Before applying for a business loan, it’s crucial to thoroughly understand all the loan terms and conditions. This includes more than just the interest rate.

Interest rate is a key factor, but equally important are the loan amount, the loan term (the repayment period), and the repayment schedule (monthly, quarterly, etc.). Understand the total cost of borrowing, including any fees or charges associated with the loan. These can include origination fees, late payment fees, and prepayment penalties.

Carefully review the collateral requirements. Will you need to pledge assets as security for the loan? If so, what are the implications if you default on the loan? Understanding the loan covenants is also vital; these are specific requirements you must meet to maintain the loan in good standing. These might relate to financial ratios, business performance, or other aspects of your business.

Don’t hesitate to ask questions. Clarity is paramount. If anything is unclear or ambiguous, seek clarification from the lender. Make sure you fully grasp every aspect of the loan agreement before signing anything. A thorough understanding of these terms will protect your business and prevent unforeseen financial difficulties.